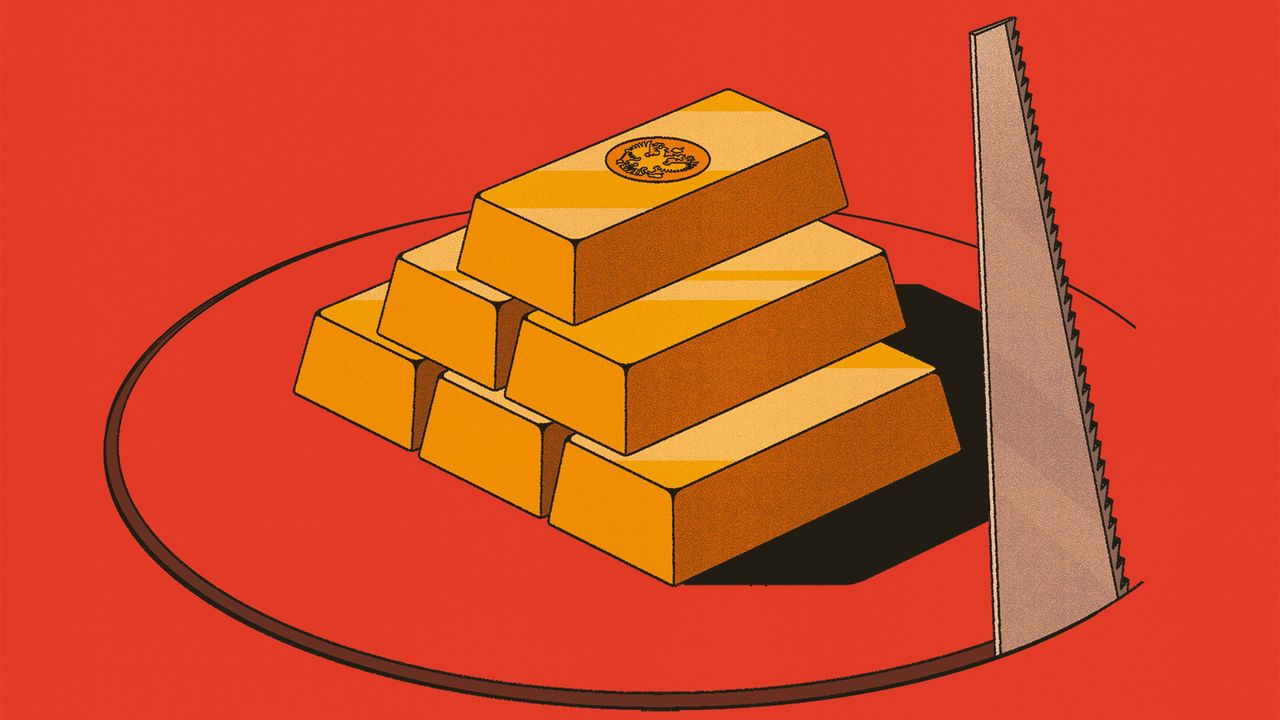

What do you do with 191bn frozen euros owned by Russia?

The question that now confronts Western policymakers

In economic terms, an asset has value because an owner might derive future benefits from it. Some assets, like cryptocurrencies, require a collective belief in those benefits. Others, like wine, will undeniably provide future pleasure, such as the ability to savour a 1974 Château Margaux. Still others, like American Treasuries, represent a claim on the government of the strongest economy in the world, backed by a formidable legal system.

Explore more

This article appeared in the Finance & economics section of the print edition under the headline “Treasure hunters”

Finance & economics March 2nd 2024

- Activist investing is no longer the preserve of hedge-fund sharks

- How Trump and Biden have failed to cut ties with China

- Uranium prices are soaring. Investors should be careful

- Stockmarkets are booming. But the good times are unlikely to last

- What do you do with 191bn frozen euros owned by Russia?

- Are passive funds to blame for market mania?

More from Finance & economics

The stockmarket rout may not be over

As investors pause for breath, we assess what could turn a correction into a crash

Why Japanese stocks are on a rollercoaster ride

Volatility in global markets continues

Why Japanese markets have plummeted

The global rout continues, with the Topix experiencing its worst day since 1987

Swing-state economies are doing just fine

They would be doing even better if the Biden-Harris administration had been more cynical

Can Kamala Harris win on the economy?

A visit to a crucial swing state reveals the problems she will face

Why fear is sweeping markets everywhere

American and Japanese indices have taken a battering. So have banks and gold