Why Japanese stocks are on a rollercoaster ride

Volatility in global markets continues

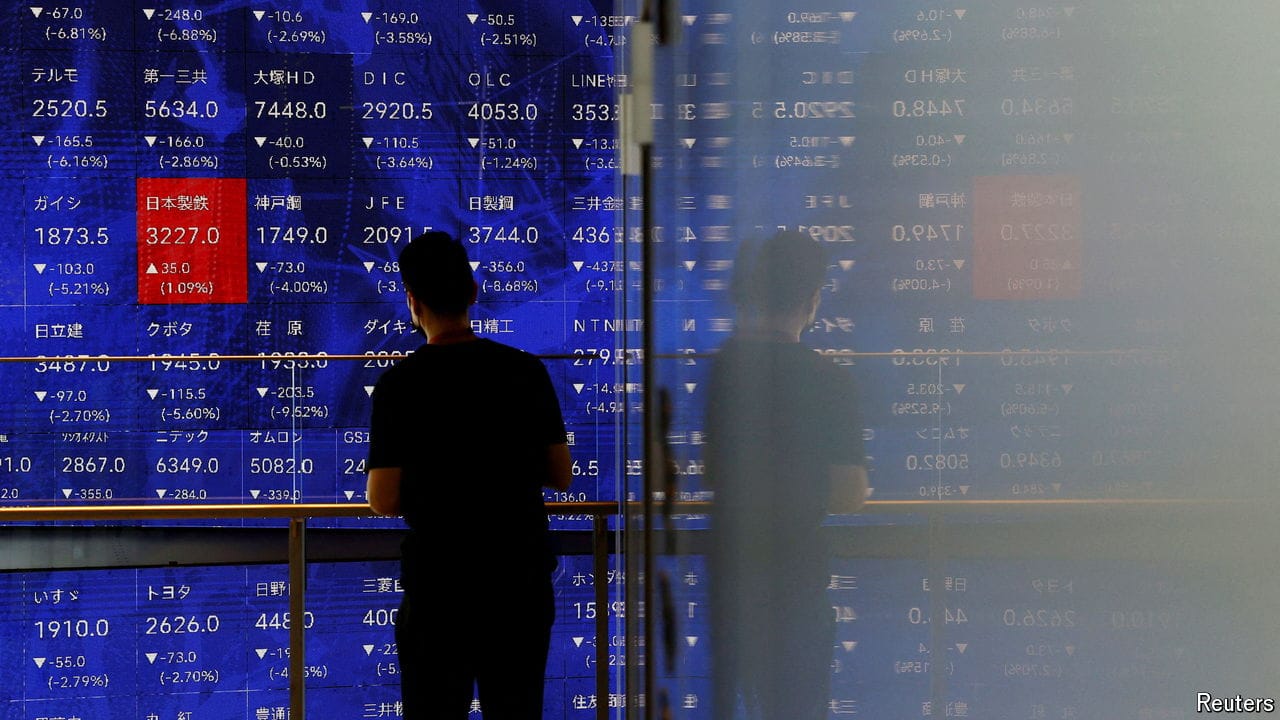

As fears of an American recession spread, stockmarkets around the world have been jittery. The moves have been the wildest of all in Japan. On August 5th the Topix plunged by 12% in its worst performance since 1987; the yen had climbed from its weakest point in 37 years. The next day, stocks swung back, rising by 9%, as investors snapped up stocks that had plunged in value. The sharp moves carry implications not just for Japanese investors and firms. The country’s financial heft means that they could become a source of further volatility in nervous global markets.

Explore more

More from Finance & economics

The stockmarket rout may not be over

As investors pause for breath, we assess what could turn a correction into a crash

Why Japanese markets have plummeted

The global rout continues, with the Topix experiencing its worst day since 1987

Swing-state economies are doing just fine

They would be doing even better if the Biden-Harris administration had been more cynical

Can Kamala Harris win on the economy?

A visit to a crucial swing state reveals the problems she will face

Why fear is sweeping markets everywhere

American and Japanese indices have taken a battering. So have banks and gold

India’s economic policy will not make it rich

A new World Bank report takes aim at emerging-market growth plans