The stockmarket rout may not be over

As investors pause for breath, we assess what could turn a correction into a crash

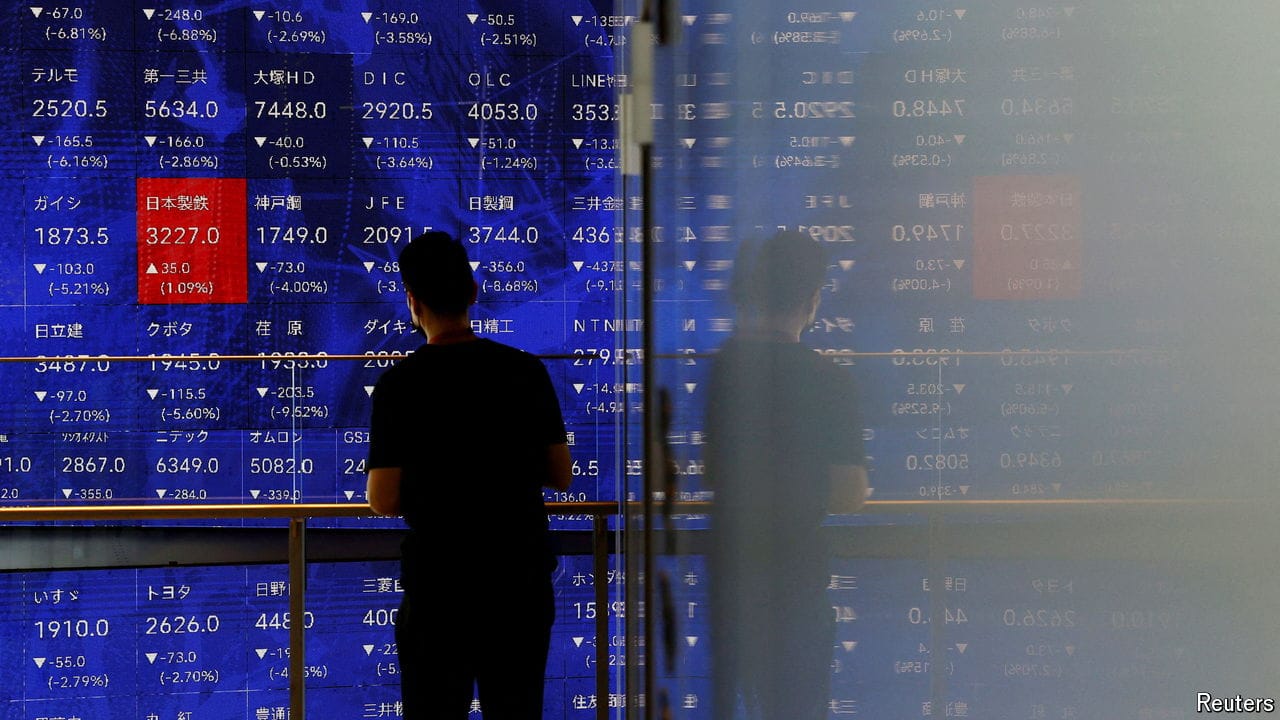

For a while on August 5th things were looking awful. During the Asian trading session Japan’s benchmark Topix share index had fallen by 12%, marking its worst day since 1987. Stock prices in South Korea and Taiwan had tanked by 9% and 8% respectively, and European markets were falling. Before trading began in America, the VIX index, which measures how wildly traders expect share prices to swing, was at a level it had only reached early in the covid-19 pandemic and after Lehman Brothers collapsed in 2008. Ominously, though gold is usually a hedge against chaos, its price was falling—suggesting that investors might be selling assets they would rather hold on to in order to stay afloat. The previous week’s rout in global markets seemed to be spiralling into a full-blown crisis.

Explore more

More from Finance & economics

Why Japanese stocks are on a rollercoaster ride

Volatility in global markets continues

Why Japanese markets have plummeted

The global rout continues, with the Topix experiencing its worst day since 1987

Swing-state economies are doing just fine

They would be doing even better if the Biden-Harris administration had been more cynical

Can Kamala Harris win on the economy?

A visit to a crucial swing state reveals the problems she will face

Why fear is sweeping markets everywhere

American and Japanese indices have taken a battering. So have banks and gold

India’s economic policy will not make it rich

A new World Bank report takes aim at emerging-market growth plans