Why Japanese markets have plummeted

The global rout continues, with the Topix experiencing its worst day since 1987

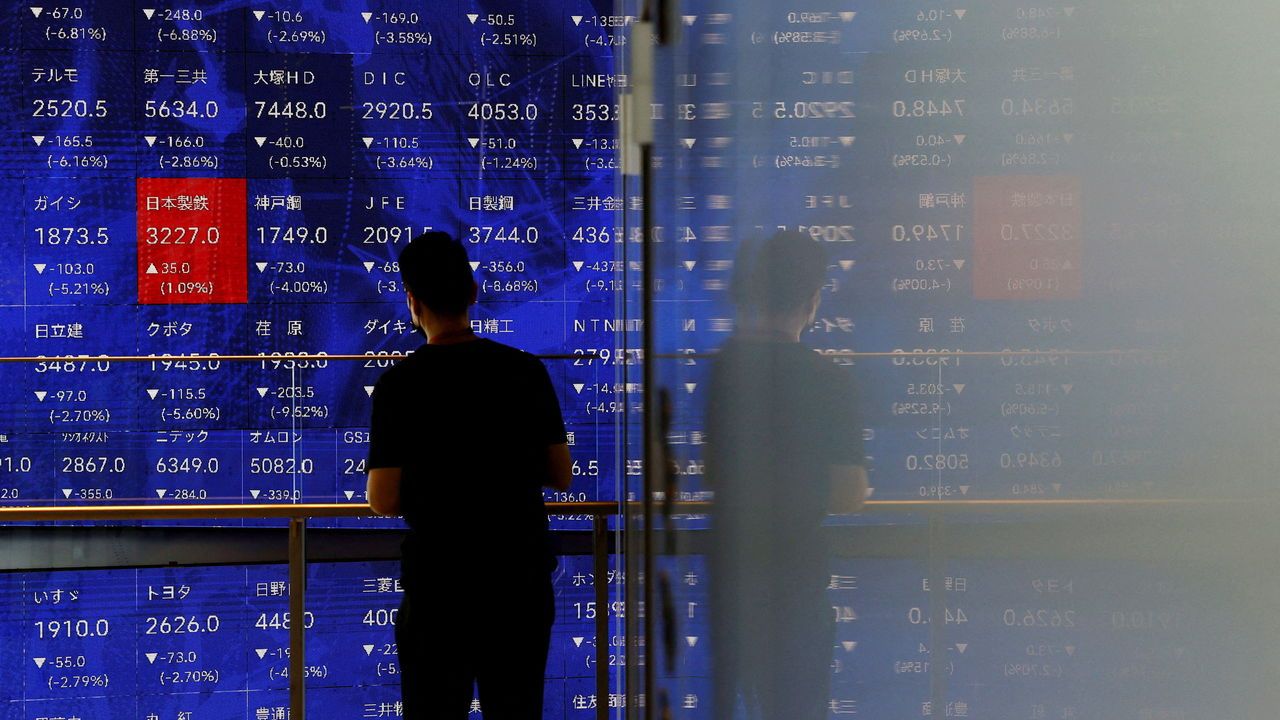

As fears of an American recession spread, stockmarkets around the world have suffered. But none has taken as severe a beating as Japan’s. On August 5th the Topix plunged by 12% in its worst performance since 1987, compared with falls of 2-3% in America, Britain and Europe. The index is now almost a quarter below its peak, reached barely a month ago. The yen, meanwhile, is snapping back: it is up 13% from less than a month ago, when it was at its weakest in 37 years. These sharp moves carry implications not just for Japanese investors and firms. The country’s financial heft means that they could become a source of further volatility in nervous global markets.

Explore more

More from Finance & economics

The stockmarket rout may not be over

As investors pause for breath, we assess what could turn a correction into a crash

Why Japanese stocks are on a rollercoaster ride

Volatility in global markets continues

Swing-state economies are doing just fine

They would be doing even better if the Biden-Harris administration had been more cynical

Can Kamala Harris win on the economy?

A visit to a crucial swing state reveals the problems she will face

Why fear is sweeping markets everywhere

American and Japanese indices have taken a battering. So have banks and gold

India’s economic policy will not make it rich

A new World Bank report takes aim at emerging-market growth plans